You can withdraw money from an ira at any time without penalty after age 59 but withdrawing money from a past employer s 401 k plan will require jumping through a few more hoops.

Benefits of rolling a 401k into an ira.

But there are times when a rollover is not your best option.

With your former employer or roll it over into an individual retirement account.

For most people rolling over a 401 k or the 403 b cousin for those in the public or nonprofit sector into an ira is the best choice.

Same goes for a roth 401 k to roth ira rollover.

Pros and cons of rolling your 401 k into an ira we tell you when it makes sense to move your 401 k account to an ira and when it s smart to stay put.

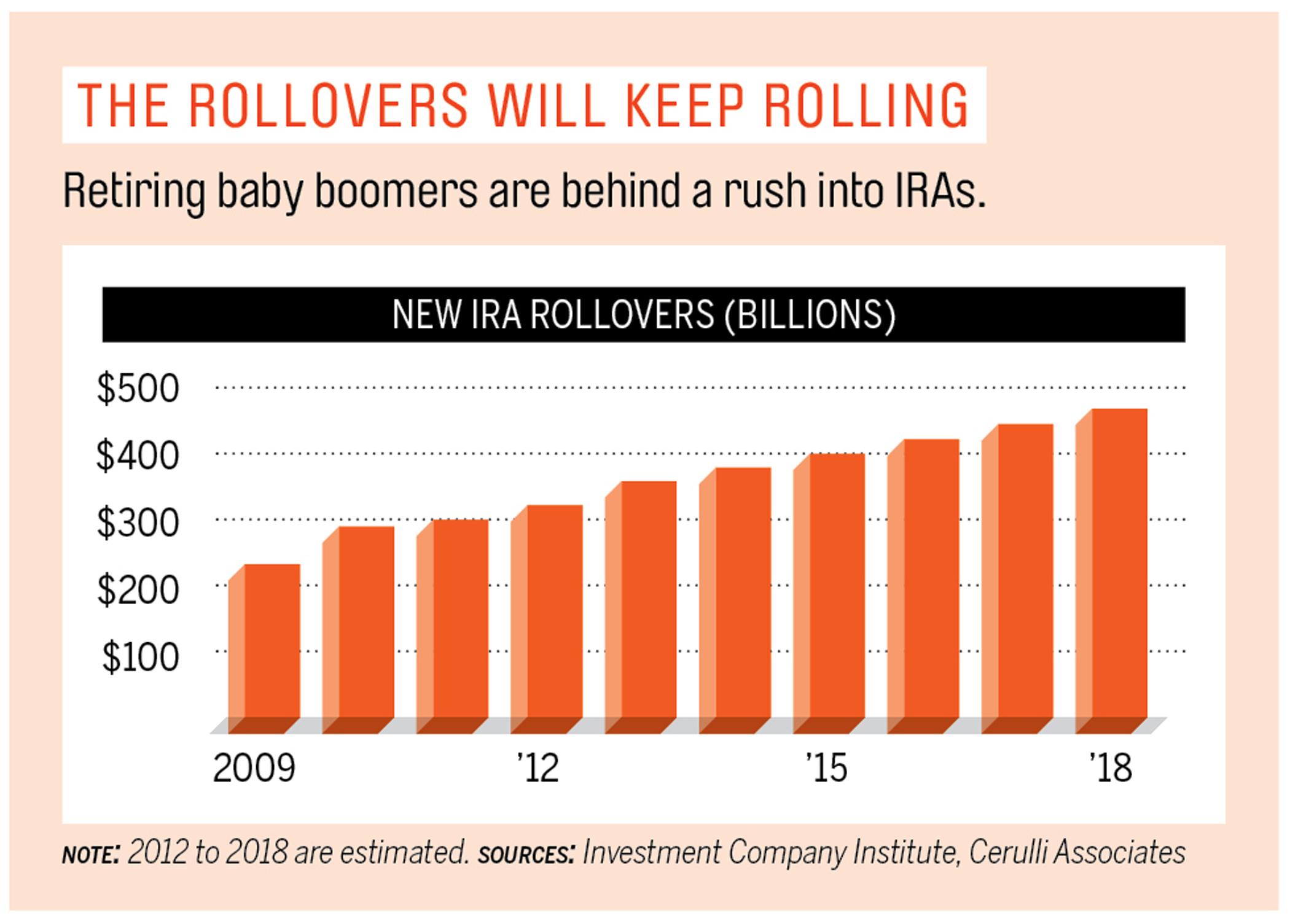

Instead the money that goes into a rollover ira is money from a previous retirement plan such as a 401 k plan.

Here are three reasons to consider rolling over a 401 k or 403 b.

Rolling your money from a 401 k plan into either a traditional or roth individual retirement account can allow you to cut the final strings with your company.

A rollover ira is identical to a traditional ira or roth ira in the case of rolling over roth 401 k funds except that the source of the money is not annual contributions.

Consider rolling over your 401 k to an ira when you retire.

Below are seven reasons why.

Beyond the type of ira you want to open you ll need choose a financial institution to invest with.

You can t roll a roth 401 k into a traditional ira.

Below are seven reasons why.

You can rollover from a traditional 401 k into a traditional ira tax free.

However you can only roll over.

-page-001_tcm113-118061.jpg)